Advanced Tax Strategies for $250K+ Earners

You're Probably Overpaying The IRS By $50,000 Or More

Watch the Short Video Below to See How We Reduce Your Taxes

🕒 Limited Tax Strategy Slots Remaining This Week

Top-Rated CPA Firm Serving High-Net-Worth Clients in Atlanta and Nationwide

15+

Years of Experience

400+

Clients Served

$50M+

Clients Tax Savings

Industries We Serve

We partner with innovators and forward-thinking business owners to simplify their financial landscape and unlock new opportunities for growth.

Our team is as diverse as the clients we serve—bringing global insight, specialized expertise and real-world experience in each field.

Our clients span diverse sectors—from eCommerce and entertainment to real estate, cryptocurrency, digital marketing, and technology, as well as medical practices, law and consulting firms, construction, transportation, and expat enterprises.

Medical Practices

Expats

Consulting Firms

Law Firms

Cryptocurrency

Technology

eCommerce

Entertainment

Real Estate

Digital Marketing

Transportation

Construction

Your CPA Said

"there's nothing more you can do."

This Is What We Actually Did:

International Real Estate Investors recover $95K in tax refunds.

Uncovered missed international deductions and amended prior U.S. filings to recover overpaid taxes.

Applied advanced depreciation strategies across multi-country real estate holdings to maximize benefits.

Recovered $95,000 in refunds—capital reinvested into a new venture supporting expatriates in Mexico.

Crypto Investor saves $100K in taxes.

Consolidated years of crypto transactions across wallets and exchanges into a structured accounting system.

Leveraged crypto winter losses to offset gains and minimize tax liabilities.

Achieved $100K in tax savings and a 5x ROI through comprehensive financial organization and planning.

Physician saves $400K in taxes through advanced real estate and business tax strategies.

Implemented cost segregation and bonus depreciation to maximize real estate deductions across properties in U.S. and Canada.

Optimized consulting business with entity restructuring, home office, and vehicle deductions.

Digital Marketing Coach saves $300K in taxes in 1 year.

Centralized four business entities under a unified accounting system for real-time financial clarity.

Integrated real estate acquisitions and accelerated depreciation into a long-term tax strategy.

Achieved $300K in tax savings and a 6x ROI while improving cash flow and compliance.

By the time high earning professionals

find us, they’re frustrated, and rightfully so.

You’re earning at the top of your field.

Yet every year, you watch tens of thousands disappear to taxes.

When you ask your CPA how to fix it, you hear the same answer:

“That’s just part of being successful.”

But deep down, you know that can’t be right.

You are correct.

At Delerme CPA, we fix that.

Our Track Record

15+ Years Maximizing

Tax Savings

400+ Clients

Successfully Supported

A+ Rating from the

Better Business Bureau

Over $50 Million in

Client Tax Savings

What Our Clients Are Saying

Our clients trust us because we deliver measurable results and lasting peace of mind.

These reviews reflect the real experiences of business owners and high income earners who’ve simplified their finances and maximized their savings with our team.

After our call, you'll walk away with:

A clear picture of why you may be overpaying in taxes.

A personalized projection on how much you can save.

A step-by-step plan to start saving now and prevent future overpayments.

Confidence that your tax strategy is both optimized and compliant.

Why Work With Delerme CPA?

In-House Tax Attorneys

Our team includes dedicated tax attorneys who ensure every strategy we implement is 100% legal, fully compliant, and defensible.

For individuals who demand precision and airtight protection, this means your tax savings are built on a rock-solid foundation.

Wealth Structuring

We help structure your finances, from entity structuring, designing advanced retirement plans, and evaluating which investments deliver the greatest tax advantages.

Most high income earners have multiple income streams, we help you leverage them to accelerate long-term wealth.

A Full Tax Team, Not Just One CPA

When you work with us, you’re not limited to a single accountant’s perspective. You get access to CPAs, tax attorneys, enrolled agents, and advisors who bring diverse expertise across industries and jurisdictions.

This team approach means sharper strategies, fewer missed opportunities, and stronger results.

Personalized, Global Solutions

No cookie-cutter strategies here. Every client’s plan is custom-tailored, accounting for cross-border investments, state and federal rules, and evolving financial goals.

With multi-jurisdictional licensing and compliance expertise, we guide you through complex landscapes seamlessly as your needs grow.

Streamlined Access and Communication

You’ll have a dedicated advisor and secure portal to track progress in real time.

Our process is designed for high earners' busy schedules — efficient, transparent, and always available when you need clarity.

Smooth sailing and constant communication are our standards.

Proven Experience for

High Income Earners

With 15+ years of experience and 400+ clients served, our bilingual team specializes in tax planning for high-income individuals and professionals.

We craft strategies tailored to each unique situation, maximizing deductions, reducing taxes, and delivering measurable results most firms can’t match.

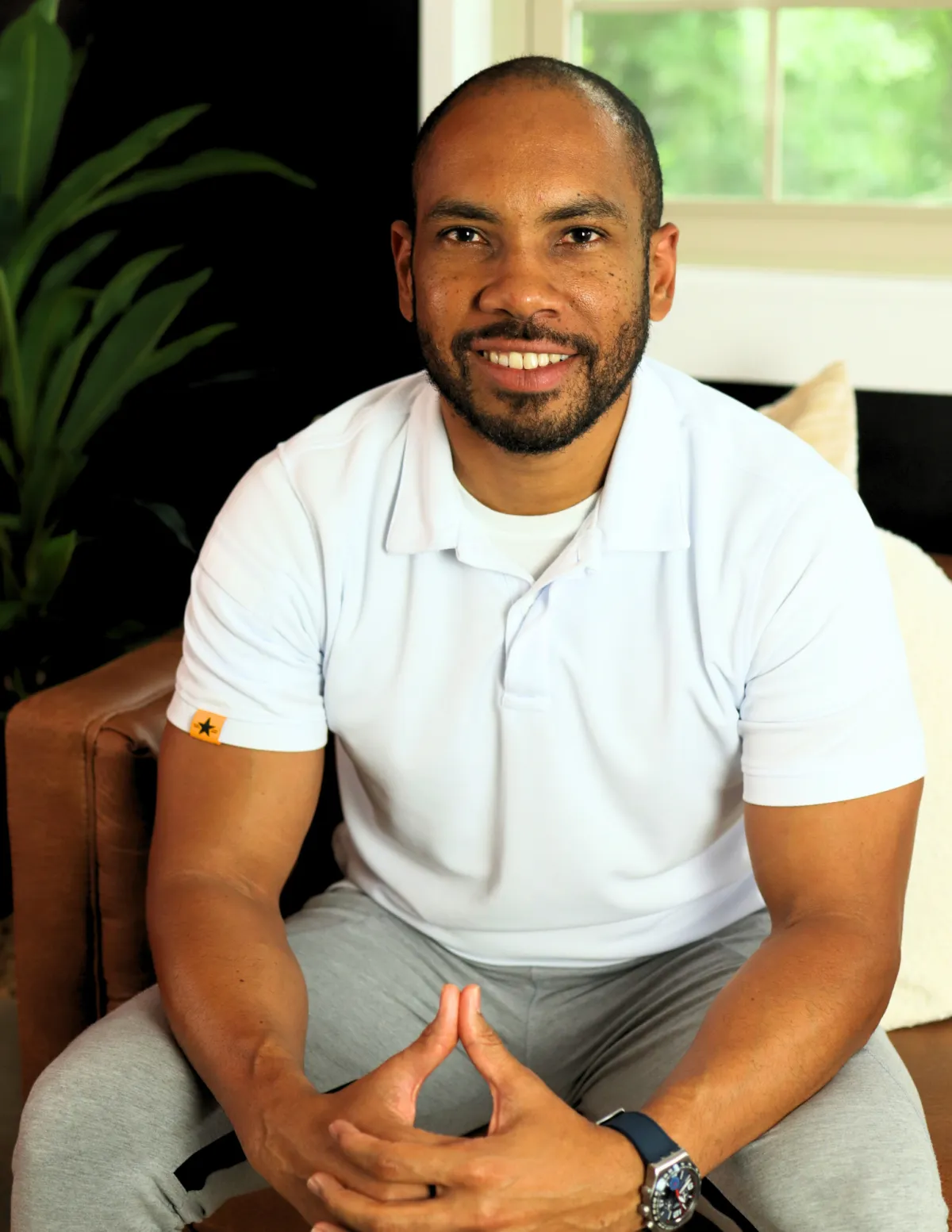

A Note from Victor Delerme,

Founder & CPA

"I’ve spent 15 years working exclusively with high-earning professionals, studying exactly where money leaks out—and how to stop it.

This is the same tax strategy system that’s helped 400+ clients reduce their tax bills by up to six figures, year after year.

Our framework focuses on the few tax strategies that deliver the biggest results, so you don’t waste time chasing scraps or risky loopholes.

We apply what the top 1% already use, proactively and legally."

Frequently Asked Questions

How can I legally lower my tax burden as a high income earner?

There are over 140 IRS-approved strategies to reduce your effective tax rate and taxable income. Some of the most powerful (especially for high earners) include:

- Maximizing contributions to high-limit retirement plans (e.g. defined-benefit, cash balance, or “stacked” plans)

- Using health-savings accounts (HSAs), flexible spending, or other pre-tax benefits

- Choosing the optimal entity structure or tax election (e.g. S-corp, LLC taxed as S, or a professional corporation)

- Accelerating or bunching deductible expenses, timing capital gains or losses, and smart charitable giving

- Depreciation, Section 179, cost segregation (for real estate or practice assets)

- State and residency planning (e.g. relocating, timing income, understanding domicile rules)

These techniques must be customized to your business, personal goals, and risk tolerance. Our team builds a tailored long-term tax plan rather than using generic checklists.

How do I know which tax strategies apply to me?

We start with a comprehensive review of your financial situation, including income sources, investments, and business interests.

From there, we identify strategies that specifically fit your circumstances. Our team has experience across multiple industries, so we can advise on approaches that are often missed by general advisors.

How do you stay up to date on tax law changes?

Our team regularly reviews new legislation, IRS guidance, and court rulings. We also invest in ongoing education and training to ensure we can implement the latest strategies safely and effectively. You benefit from strategies that are both innovative and fully compliant.

How do I get started?

Getting started is simple. Book a call with our team, and we’ll conduct a thorough assessment of your financial situation.

From there, we’ll develop a clear, actionable plan tailored to your income, investments, and goals.

What types of clients do you work with?

We work with high-earning individuals, entrepreneurs, business owners, and investors across all industries. Our team has deep expertise in international taxation, business structures, investments, and complex financial situations.

We serve professionals across the board such as crypto investors, real estate investors, physicians, technology business owners, entertainers, restaurant owners, online retailers, attorneys, etc.

We also assist individuals and business owners with unique compliance matters such as expat taxes and international tax compliance.

What role should my CPA play in reducing taxes vs. just filing returns?

A high-value CPA (or firm) should not simply be a “tax return filer,” but a proactive tax planner / strategist. Here’s how they differ:

Tax preparer: Backward-looking: collect your documents, fill and file returns. Works mostly around tax season and ensures compliance while claiming deductions you already qualify for.

Tax planner / tax strategist: Forward-looking: design business & financial structure to reduce tax burden. Works all year long, not only during tax season, with periodic reviews. Their strategies lower your future taxes, shift income/deductions optimally, and anticipates changes.

Many CPAs or firms do both roles to a degree, but not all are skilled or experienced in advanced tax planning. Some may stick to preparation because it's lower risk, easier to standardize, or because they lack deep knowledge in strategies for high earners.

Your tax planner should essentially be your partner who sees your full financial picture and integrates planning into your business and personal life.

If these strategies are legal, why hasn't my previous CPA recommended them already?

Just because a strategy is legal doesn’t mean every CPA will (or can) recommend it. Below we'll outline some reasoning behind this:

Scope / specialization: Some CPAs focus primarily on compliance and preparation rather than proactive tax strategy (they may not have training or comfort with riskier structures).

Lack of depth or resources: Advanced planning often involves modeling, projections, multi-jurisdictional work, legal input, and deeper knowledge that not all CPA firms have. Many CPAs operate as a one-person show, which means less expertise among many different sectors and strategies.

Misalignment of incentives: A preparer may not be compensated (or incentivized) to dig into year-round planning.

Client timing / awareness: Many individuals only engage a planner late in the year (or after the tax season) — by then, many strategic “windows” are closed.

At our firm, we blend compliance, planning, and legal oversight (CPAs + tax attorneys) so clients aren’t left relying on one perspective.

How do I evaluate a CPA firm to ensure they're true tax planners and not just tax preparers?

Here’s a quick checklist of traits, questions, and signs of a genuine strategic tax partner:

✔ Credentials & specialization

- Look for CPAs with advanced tax credentials, credentials in multiple jurisdictions (or familiarity with cross-state issues)

- Experience working with high-income professionals (doctors, specialists)

- Partnerships with tax attorneys or in-house legal support

✔ Process and communication

- They should ask forward-looking planning questions (cashflow, risk tolerance, growth plans), not just “give me your W-2s/1099s”

- Year-round check-ins or midyear reviews, not just “once a year”

- Scenario modeling and forecasting, not vanilla “fill in blanks”

✔ Depth of offering

- Offer entity design (LLC, S-Corp elections, professional corp advice)

- Retirement plan design and contribution modeling

- State residency / domicile planning

- Audit defense or proactive documentation support

Your biggest tax savings are waiting, will you claim them or miss out?

DELERME CPA

Copyright ©2025 Delerme CPA. All rights reserved.

Privacy Policy and Terms of Service

LOCATIONS:

Atlanta: 4651 Roswell Road, B105, Atlanta, GA 30342

Puerto Rico: 807 Ave Ponce de Leon PMB 0406, San Juan, PR 00907

Miami: 31 SE 5th Street, Suite CU204. Miami, FL, 33131

CONTACT: 678-585-6580 | [email protected]