Advanced Tax Strategies For business Owners and Investors Paying $100,000+ in taxes:

Legally Pay 4% Business Tax and

0% Capital Gains Taxes

with Puerto Rico's Act 60 Tax Incentives

Watch the short video below to find out how:

NOTICE: You must apply for your tax decree NOW to lock in the prevailing 0% capital gains and 4% business tax rates.

We receive 25+ Act 60 consultation requests every week and have only a handful of intake slots left.

Calls are first-come, first-serve.

Top-Rated CPA Firm Serving High-Net-Worth Clients in the U.S. and Globally

15+

Years of Experience

400+

Clients Served

$50M+

Clients Tax Savings

Your CPA Said

"there's nothing more you can do."

This Is What We Actually Did:

$700K tax savings for a legal consulting firm owner earning over $1MM.

He relocated to Puerto Rico, but his previous CPA missed key Act 60 tax incentives.

We stepped in with a dual-jurisdiction strategy and helped him secure a $300K refund and $400K in future savings, turning a $75K investment into a 10x ROI to fuel his business growth.

$1.3MM in overpaid taxes RECOVERED for this Georgia-based financial asset manager.

He sold his business and continued operating under Puerto Rico’s Act 60, but his prior CPA mishandled filings. He was left with nearly $1.3MM in overpaid taxes.

Our two-phase strategy recovered a $990K capital gains refund and $320K from export services, giving him capital to reinvest and full confidence in his tax strategy moving forward.

Act 60 setup paid for by U.S. tax savings!

Ryan Calloway, a financial consulting firm owner in Georgia, implemented a compliant Act 60 setup and a U.S. tax plan to capture immediate savings.

His U.S. tax savings fully covered the Act 60 setup, while positioning him for long-term Puerto Rico benefits and giving him complete peace of mind.

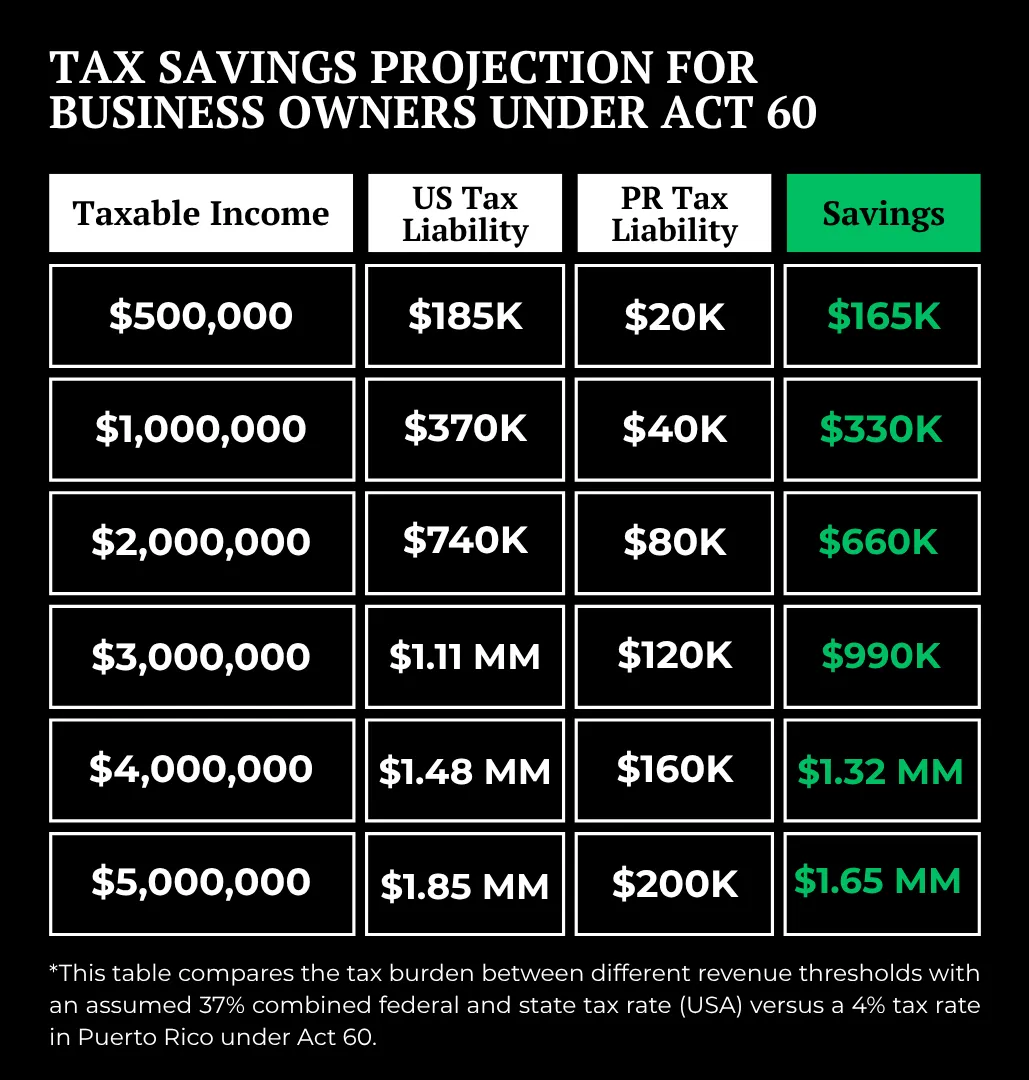

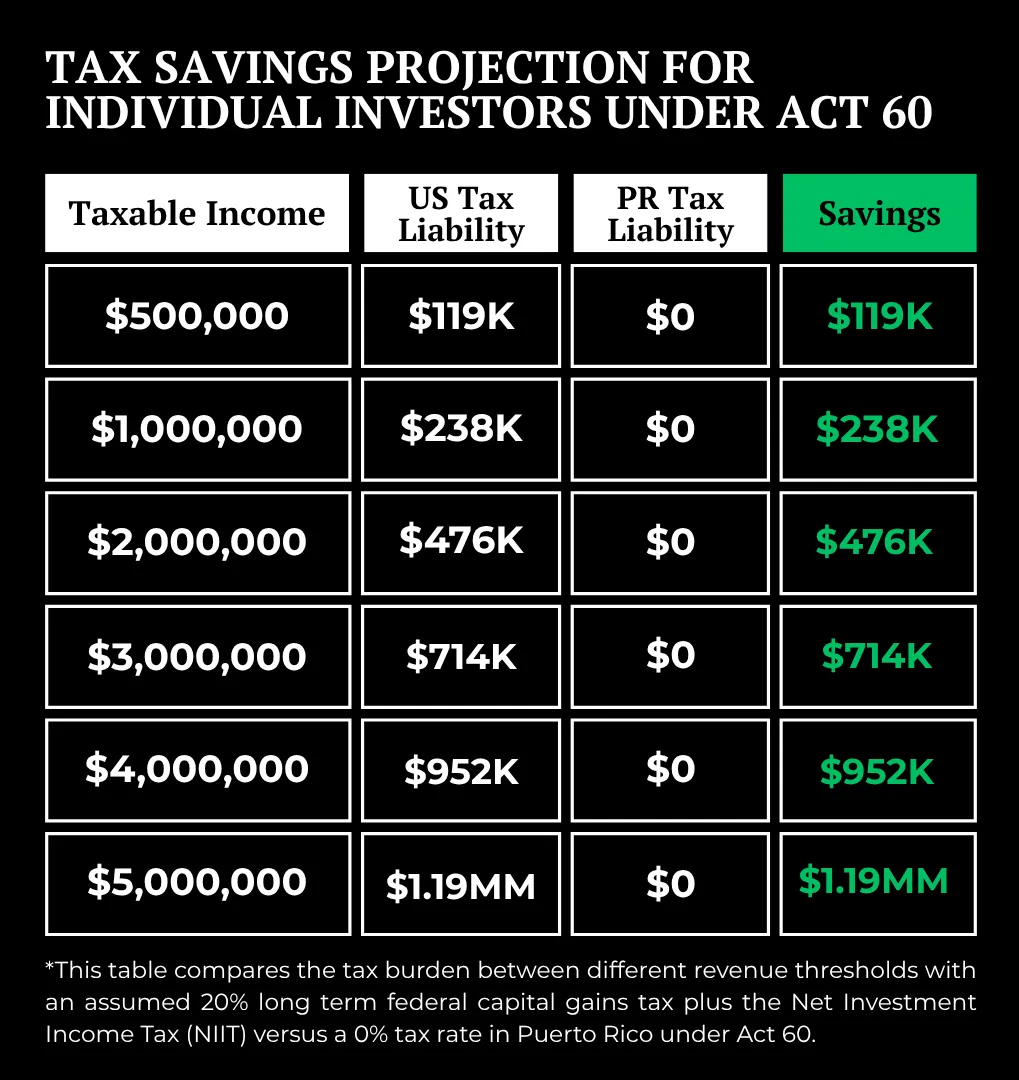

Compare Tax Liabilities

Based on Your Revenue and Income

To truly appreciate how your life and business could change, identify your taxable income amount below to compare how much you could save using Puerto Rico's Act 60.

By the time high earning professionals

find us, they’re frustrated, and rightfully so.

You’re earning at the top of your field.

Yet every year, you watch tens of thousands disappear to taxes.

When you ask your CPA how to fix it, you hear the same answer:

“That’s just part of being successful.”

But deep down, you know that can’t be right.

You are correct.

At Delerme CPA, we fix that.

What Our Clients Are Saying

Our clients trust us because we deliver measurable results and lasting peace of mind.

These reviews reflect the real experiences of business owners and high income earners who’ve simplified their finances and maximized their savings with our team.

After our call, you'll walk away with:

A personalized projection on how much you can save.

A clear action plan to maximize your tax situation.

Insight into how Act 60 works and how you can stay compliant and avoid audits.

About Delerme CPA

Wondering why clients choose us?

Because we bring a full tax team to the table—not just one CPA. With in-house tax attorneys, global wealth structuring, efficient communication, and a proven track record with high-income earners, we deliver personalized tax strategies that scale with your success.

In-House Tax Attorneys

Our team includes dedicated tax attorneys who ensure every strategy we implement is 100% legal, fully compliant, and defensible.

For physicians who demand precision and airtight protection, this means your tax savings are built on a rock-solid foundation.

Act 60 Compliance Experts

Our Act 60 concierges and tax experts stay fully up to date on every change to PR’s tax incentive laws, ensuring your decree remains in complete compliance.

From annual filings to evolving regulations, our team handles every detail so you can focus on growing your business with peace of mind.

A Full Tax Team, Not Just One CPA

When you work with us, you’re not limited to a single accountant’s perspective. You get access to CPAs, tax attorneys, enrolled agents, and advisors who bring diverse expertise across industries and jurisdictions.

This team approach means sharper strategies, fewer missed opportunities, and stronger results.

Streamlined Access and Communication

You’ll have a dedicated advisor and secure portal to track progress in real time.

Our process is designed for physicians’ busy schedules — efficient, transparent, and always available when you need clarity.

Smooth sailing and constant communication are our standards.

A Note from Victor Delerme,

Founder & CPA

"Born and raised in Puerto Rico, I’ve spent nearly two decades helping U.S. entrepreneurs bridge both tax systems seamlessly.

As a CPA licensed in Puerto Rico and the U.S., my team and I specialize in creating fully compliant structures that maximize Act 60 benefits while staying in perfect sync with mainland requirements.

Our goal is simple, to help you keep more of what you earn, legally and strategically."

Frequently Asked Questions

Is this really legal?

Absolutely! Act 60 is 100% legal and fully recognized by both the Federal Government and the Puerto Rican Government.

As stated in Chapter 1 Section 1010.01. - "Declaration of Public Policy" of the Puerto Rico Incentives Code, its goal is to stimulate economic development through tax benefits for businesses and residents.

As long as you meet the compliance requirements, you can lawfully enjoy its advantages, and we’re here to guide you every step of the way, so you never have to worry about legal issues

Who qualifies for Act 60?

- Business owners (earning $250,000+ annually) who export services such as: Consulting Services, Advertising and PR, Tech and Software, Project Management, Telemedicine, Health and Lab Services, Marketing Services, Financial Services, Professional Services, Call Centers, etc.

*On a quick consultation call, we can confirm if your business qualifies for Act 60 tax incentives.

- Investors, and high-income earners who relocate to Puerto Rico and meet residency requirements. This includes investors for crypto, stocks, etc.

Do you help with Act 60 applications and business set up?

Absolutely! Our dedicated Act 60 concierge team guides you through every step of the process—from gathering the required paperwork and submitting your application to monitoring its progress with government agencies.

Beyond compliance, we also handle bona fide business establishment and setup in Puerto Rico, ensuring you qualify for the incentives. Our Act 60 application and business set up services help you get established in Puerto Rico before it’s time to file taxes.

Do I need to work with an attorney for my Act 60 application?

Not necessarily. While you don’t need an attorney or a licensed CPA to apply, it’s highly encouraged to work with a team that has legal expertise built in. At Delerme CPA, we have attorneys on our team who ensure every step of the process is handled in full compliance with Puerto Rico and U.S. tax codes.

This way, your application and business setup are audit-proof, legally sound, and designed to secure your eligibility for the incentives with confidence.

Do I need to become a Puerto Rican resident to qualify?

Investors are required to establish residency, and we’ll help you navigate the process to maximize your benefits.

For business owners, full-time residency is not required, but you must meet specific criteria, and we’ll guide you through every step.

Will the Puerto Rico Incentives Code (Act 60) tax rates go up in 2026?

For applicants who secure a decree under Act 60 before January 1, 2026, the current benefits—including a 0% tax rate on Puerto Rico-sourced capital gains, interest and dividends (for eligible Individual Investors) — remain fully protected as part of the binding contract with the government.

Starting January 1, 2026, however, proposed legislation and public commentary indicate that new Individual Investor-program applicants will face a flat 4% tax on Puerto Rico-sourced capital gains, interest and dividends instead of 0%.

That said, the core export-services business rate (4%) and many business-related incentives under Act 60 remain unchanged in the announced reform measures.

How much can I save?

Many clients legally reduce their tax burden to 4% or even eliminate capital gains taxes entirely.

My CPA doesn’t know about Act 60. How can I trust this?

You’re not alone—many CPAs aren’t familiar with Puerto Rico’s tax incentives. We specialize in Act 60 and simplify the rules so you can take full advantage of the benefits without any confusion or second-guessing.

What to Expect When You Work With Us?

Our process is designed to make tax savings simple and stress-free. It starts with a free first consultation, where we assess your eligibility and savings potential.

Next, we create a customized strategy tailored to your business and financial goals. Our team then ensures seamless implementation, guiding you through every step of the Act 60 application and compliance process.

Finally, we provide ongoing support, offering continuous tax planning to keep you compliant and maximize long-term savings.

Does moving to Puerto Rico fit my lifestyle? What should I expect?

It’s the question almost everyone asks, and it’s a fair one. The tax benefits under Act 60 are powerful, but living here has to make sense for you.

Life on the island offers year-round sunshine, beautiful beaches, and a growing community of entrepreneurs and investors who’ve made the same move. English and Spanish are both widely spoken, U.S. citizens don’t need a passport, and most major cities are a short flight away.

That said, relocating is a big decision. Some areas may feel different from the mainland U.S., and it can take time to adjust. That’s why we walk our clients through the lifestyle considerations as much as the tax rules — so you can make an informed choice. For many, Puerto Rico becomes not just a tax strategy, but a lifestyle upgrade.

This all sounds too complicated. Where do I even start?

It’s simpler than you think. After helping many Act 60 clients, our team has developed a step-by-step guide through the entire process. From our clear engagement letter to personalized support, we make sure you know exactly what to do, while we handle the hard part for you.

Take the first step, book a free first call consultation with our experts to determine your eligibility and start your application process.

Your biggest tax savings are waiting,

will you claim them or miss out? Click now!

DELERME CPA Accounting | Tax | Consulting

Copyright ©2025 Delerme CPA. All rights reserved.

Privacy Policy and Terms of Service

LOCATIONS:

Atlanta: 4651 Roswell Road, B105, Atlanta, GA 30342

Puerto Rico: 807 Ave Ponce de Leon PMB 0406, San Juan, PR 00907

Miami: 31 SE 5th Street, Suite CU204. Miami, FL, 33131

CONTACT: 939-236-3532 | [email protected]